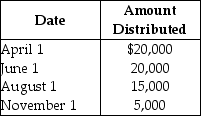

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Wills Corporation, which has accumulated a current

Q29: Hogg Corporation distributes $30,000 to its sole

Q33: A shareholder's basis in property distributed as

Q35: Outline the computation of current E&P, including

Q36: Peach Corporation was formed four years ago.Its

Q37: Kiara owns 100% of the shares of

Q38: Tia receives a $15,000 cash distribution from

Q39: Identify which of the following statements is

Q41: Which of the following transactions does not

Q49: What is a constructive dividend? Under what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents