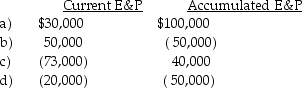

Green Corporation is a calendar-year taxpayer.All of the stock is owned by Evan.His basis for the stock is $35,000.On March 1 (of a non-leap year),Green Corporation distributes $120,000 to Evan.Determine the tax consequences of the cash distribution to Evan in each of the following independent situations:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Splash Corporation has $50,000 of taxable income

Q25: Wills Corporation, which has accumulated a current

Q26: Dixie Corporation distributes $31,000 to its sole

Q29: Hogg Corporation distributes $30,000 to its sole

Q30: Corporations recognize gains and losses on the

Q31: River Corporation's taxable income is $25,000, after

Q32: When appreciated property is distributed in a

Q34: One consequence of a property distribution by

Q38: Tia receives a $15,000 cash distribution from

Q40: When computing E&P and taxable income, different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents