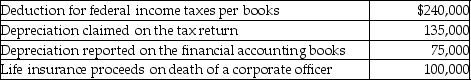

Bishop Corporation reports taxable income of $700,000 on its tax return.Given the following information from the corporation's records,determine Bishop's net income per its financial accounting records.

A) $520,000

B) $620,000

C) $660,000

D) $560,000

Correct Answer:

Verified

Q83: Identify which of the following statements is

Q88: Identify which of the following statements is

Q94: You are the CPA who prepares the

Q100: Corporate estimated tax payments are due April

Q106: Dreyfuss Corporation reports the following items:

Q108: Ben and Jerry Corporations are members of

Q109: Winter Corporation's taxable income is $500,000.In addition,Winter

Q112: Which of the following results in a

Q114: Deferred tax liabilities occur when expenses are

Q115: Grant Corporation is not a large corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents