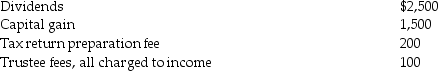

A trust document does not define income and principal.The state in which the trust is operated has adopted the Uniform Act.The trust reports the following:  What is the amount of trust's net accounting income?

What is the amount of trust's net accounting income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Explain to a client the significance of

Q22: A trust document does not define income

Q23: A trust document does not mention the

Q23: Charitable contributions made by a fiduciary

A)are limited

Q24: A trust distributes 30% of its income

Q27: Outline the classification of principal and income

Q28: Little Trust, whose trust instrument is silent

Q29: Estates and trusts

A)are taxed on state and

Q32: A simple trust

A)may make charitable distributions.

B)may make

Q34: The exemption amount for an estate is

A)$0.

B)$100.

C)$300.

D)$600.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents