Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago.This year the land is distributed to Sergio,another partner in the partnership.At the time of distribution,the land had a $12,000 FMV.How much gain should Mirabelle and Sergio recognize?

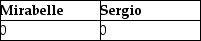

A)

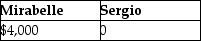

B)

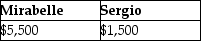

C)

D)

Correct Answer:

Verified

Q1: A partnership cannot recognize a gain or

Q4: Helmut contributed land with a basis of

Q8: Identify which of the following statements is

Q9: If a partnership asset with a deferred

Q10: In a current distribution, the partner's basis

Q13: Tenika has a $10,000 basis in her

Q13: Becky has a $24,000 basis in her

Q14: Tenika has a $10,000 basis in her

Q18: The total bases of all distributed property

Q20: Mirabelle contributed land with a $5,000 basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents