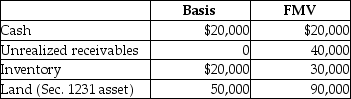

The ABC Partnership owns the following assets on December 31.  The indication that ABC owns substantially appreciated inventory is

The indication that ABC owns substantially appreciated inventory is

A) the total FMV of all assets except cash is greater than their total basis.

B) the FMV of all assets except land is $90,000 while their bases is $40,000.

C) the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

D) the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

Correct Answer:

Verified

Q23: The XYZ Partnership owns the following assets

Q23: On November 30, Teri received a current

Q25: For Sec. 751 purposes, "substantially appreciated inventory"

Q26: The TK Partnership has two assets: $20,000

Q27: Two years ago,Tom contributed investment land with

Q30: The definition of "unrealized receivable" does not

Q33: When Rachel's basis in her interest in

Q34: For purposes of Sec. 751, inventory includes

Q36: The Internal Revenue Code includes which of

Q39: Jerry has a $50,000 basis for his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents