Before receiving a liquidating distribution,Kathy's basis in her interest in the KLM Partnership is $30,000.The distribution consists of $5,000 in money,inventory having a $1,000 basis to the partnership and a $2,000 FMV,and two parcels of undeveloped land (not held as inventory) having basis of $3,000 and $9,000 to the partnership with FMVs of $5,000 and $12,000,respectively.What is Kathy's basis in each parcel of land?

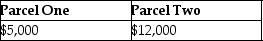

A)

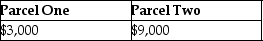

B)

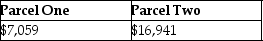

C)

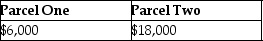

D)

Correct Answer:

Verified

Q22: The definition of "inventory" for purposes of

Q27: Identify which of the following statements is

Q32: Last year, Cara contributed investment land with

Q36: The XYZ Partnership owns the following assets

Q40: Jerry has a $50,000 basis for his

Q43: The Tandy Partnership owns the following assets

Q45: Identify which of the following statements is

Q45: Steve sells his 20% partnership interest having

Q50: Do most distributions made by a partnership

Q54: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents