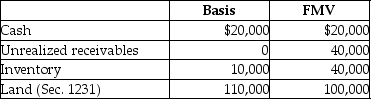

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash.At the time of the sale,the partnership has no liabilities and its assets are as follows:  Kenya and Ebony have no agreement concerning the allocation of the sales price.Ordinary income recognized by Kenya as a result of the sale is

Kenya and Ebony have no agreement concerning the allocation of the sales price.Ordinary income recognized by Kenya as a result of the sale is

A) $6,000.

B) $12,000.

C) $14,000.

D) $16,000.

Correct Answer:

Verified

Q46: The sale of a partnership interest always

Q48: Ten years ago, Latesha acquired a one-third

Q49: A partner's holding period for a partnership

Q55: Ted King's basis for his interest in

Q57: A partner can recognize gain, but not

Q58: Eicho's interest in the DPQ Partnership is

Q61: On December 31,Kate sells her 20% interest

Q63: David sells his one-third partnership interest to

Q64: Joshua is a 40% partner in the

Q69: For tax purposes, a partner who receives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents