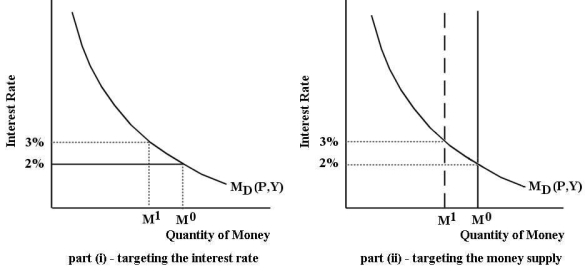

The diagrams below illustrate two alternative approaches to implementing monetary policy.The economy begins in monetary equilibrium with the interest rate equal to 2% and the money supply equal to  .

.  FIGURE 28-1 Refer to Figure 28-1.The Bank of Canada must be able to easily communicate its monetary policy actions to the public.Which approach is more amenable to this requirement,and why?

FIGURE 28-1 Refer to Figure 28-1.The Bank of Canada must be able to easily communicate its monetary policy actions to the public.Which approach is more amenable to this requirement,and why?

A) Part (ii) - targeting the money supply: because an announcement of a 1% decrease in the money supply is more easily understood than an increase in the interest rate.

B) Part (i) - targeting the interest rate: because the Bank of Canada can more easily instruct the commercial banks to raise their interest rates.

C) Part (ii) - targeting the money supply: because the public can more easily understand that a decrease in reserves in the banking system makes it more difficult to get a loan or mortgage.

D) Part (i) - targeting the interest rate: because changes in the interest rate are much more meaningful and understandable to the public than changes in the money supply.

Correct Answer:

Verified

Q1: In general,if a central bank chooses to

Q2: Suppose the Bank of Canada wants to

Q3: In general,if a central bank chooses to

Q4: The Bank of Canada chooses to influence

Q6: In practice,the Bank of Canada implements its

Q7: In practice,the Bank of Canada uses monetary

Q8: The diagrams below illustrate two alternative approaches

Q9: The diagrams below illustrate two alternative approaches

Q10: One reason the Bank of Canada does

Q11: Consider the implementation of monetary policy.One difficulty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents