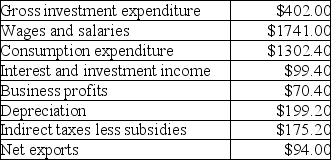

The table below includes data for a one-year period required to calculate GDP from the income side for a teeny-tiny economy.  TABLE 20-4 Refer to Table 20-4.When calculating GDP from the income side,we need to add together the following items from the data provided:

TABLE 20-4 Refer to Table 20-4.When calculating GDP from the income side,we need to add together the following items from the data provided:

A) interest and investment income,business profits,depreciation,indirect taxes less subsidies.

B) wages and salaries,business profits,indirect taxes less subsidies.

C) investment expenditure,consumption expenditure,net exports.

D) interest and investment income,business profits,depreciation.

E) wages and salaries,interest and investment income,business profits,depreciation,indirect taxes less subsidies.

Correct Answer:

Verified

Q56: In national-income accounting,government expenditures on the salaries

Q57: Consider Canada's national accounts.An example of a

Q58: Why are transfer payments excluded from the

Q59: If a firm's depreciation exceeds its gross

Q60: When measuring actual gross domestic product from

Q62: When calculating GDP from the income side,which

Q63: Historically,nominal GDP has increased faster than real

Q64: The table below shows total output for

Q65: In national-income accounting,the concept of "net domestic

Q66: The table below includes data for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents