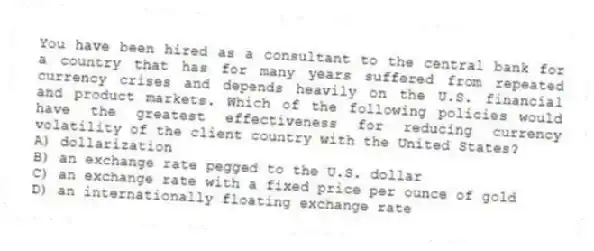

You have been hired as a consultant to the central bank for a country that has for many years suffered from repeated currency crises and depends heavily on the U.S. financial and product markets. Which of the following policies would have the greatest effectiveness for reducing currency volatility of the client country with the United States?

A) dollarization

B) an exchange rate pegged to the U.S. dollar

C) an exchange rate with a fixed price per ounce of gold

D) an internationally floating exchange rate

Correct Answer:

Verified

Q51: A currency board exists when a country's

Q52: The European Central Bank is a strong

Q53: Bretton Woods required less in the way

Q54: List and explain three benefits the euro

Q55: Which of the following is NOT an

Q56: In January 2000 Ecuador officially replaced its

Q57: Dollarization is a common solution for countries

Q59: Regime structures like the gold standard required

Q60: A currency board exists when a country's

Q61: Explain how all exchange rate regimes must

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents