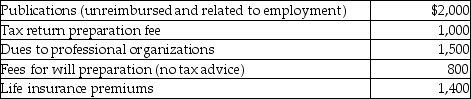

West's adjusted gross income was $90,000. During the current year he incurred and paid the following:  Assuming he can itemize deductions, how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Assuming he can itemize deductions, how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

A) $2,700

B) $4,500

C) $3,500

D) $5,300

Correct Answer:

Verified

Q6: Allison,who is single,incurred $4,000 for unreimbursed employee

Q41: The maximum tax deductible contribution to a

Q44: In which of the following situations is

Q49: A qualified pension plan requires that employer-provided

Q50: Nonqualified deferred compensation plans can discriminate in

Q51: Under a qualified pension plan,the employer's deduction

Q51: The maximum tax deductible contribution to a

Q58: In a defined contribution pension plan,fixed amounts

Q74: A sole proprietor establishes a Keogh plan.The

Q76: Corporations issuing incentive stock options receive a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents