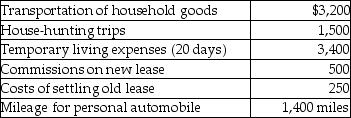

Ron obtained a new job and moved from Houston to Washington. He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses, what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses, what is the amount of the deduction?

A) $3,529

B) $6,600

C) $9,179

D) $3,984

Correct Answer:

Verified

Q33: Ron is a university professor who accepts

Q36: Gwen traveled to New York City on

Q58: Matt is a sales representative for a

Q62: Austin incurs $3,600 for business meals while

Q64: Joe is a self-employed tax attorney who

Q74: A sole proprietor establishes a Keogh plan.The

Q77: The following individuals maintained offices in their

Q80: All taxpayers are allowed to contribute funds

Q80: In which of the following situations is

Q82: An employer receives an immediate tax deduction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents