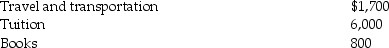

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a. If Ellie is self-employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by his employer, what are the amount of and the nature of the deduction for these expenses (after limitations)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: All of the following are true with

Q101: Feng,a single 40 year old lawyer,is covered

Q104: Tucker (age 52)and Elizabeth (age 48)are a

Q107: Rita, a single employee with AGI of

Q107: Tyne is a 48-year-old an unmarried taxpayer

Q109: Ruby Corporation grants stock options to Iris

Q113: During 2014,Marcia,who is single and is covered

Q114: Tyler (age 50)and Connie (age 48)are a

Q116: H (age 50)and W (age 48)are married

Q119: Hannah is a 52-year-old an unmarried taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents