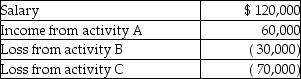

Jana reports the following income and loss:  Activities A, B, and C are all passive activities.

Activities A, B, and C are all passive activities.

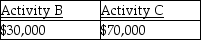

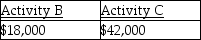

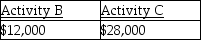

Based on this information, Joy has the following suspended losses:

A)

B)

C)

D)

Correct Answer:

Verified

Q1: Stacy,who is married and sole shareholder of

Q8: Juan has a casualty loss of $32,500

Q17: In 2000,Michael purchased land for $100,000.Over the

Q18: All of the following losses are deductible

Q29: A closely held C Corporation's passive losses

Q42: Joy reports the following income and loss:

Q52: Jeff owned one passive activity.Jeff sold the

Q57: Jorge owns activity X which produced a

Q71: If a taxpayer suffers a loss attributable

Q93: For a bad debt to be deductible,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents