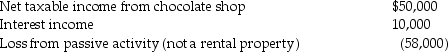

Hersh realized the following income and loss this year:

a. Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship. Determine Hersh's AGI and any carryovers.

a. Assume Hersh is an individual taxpayer and the chocolate shop is his sole proprietorship. Determine Hersh's AGI and any carryovers.

b. Assume the taxpayer is Hersh Inc., a C corporation, owned 100% by the Hersh family. Determine Hersh Inc.'s taxable income and any carryovers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Justin has AGI of $110,000 before considering

Q46: A taxpayer's rental activities will be considered

Q77: Hope sustained a $3,600 casualty loss due

Q78: Leonard owns a hotel which was damaged

Q81: Last year,Abby loaned Pat $10,000 as a

Q83: Adam owns interests in partnerships A and

Q84: Determine the net deductible casualty loss on

Q86: Vera has a key supplier for her

Q91: Constance,who is single,is in an automobile accident

Q106: A taxpayer incurs a net operating loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents