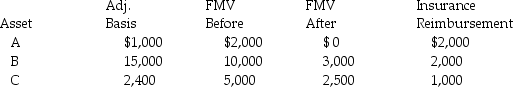

Wes owned a business which was destroyed by fire in May 2014. Details of his losses follow:

His AGI without consideration of the casualty is $45,000.

His AGI without consideration of the casualty is $45,000.

What is Wes's net casualty loss deduction for 2013?

Correct Answer:

Verified

Q76: Aretha has AGI of less than $100,000

Q81: Martha,an accrual-method taxpayer,has an accounting practice.In 2013,she

Q81: Last year,Abby loaned Pat $10,000 as a

Q85: In October 2014,Jonathon Remodeling Co.,an accrual-method taxpayer,remodels

Q89: Becky, a single individual, reports the following

Q90: Juanita,who is single,is in an automobile accident

Q91: Constance,who is single,is in an automobile accident

Q92: Which of the following expenses or losses

Q93: In 2013 Grace loaned her friend Paula

Q95: Kendal reports the following income and loss:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents