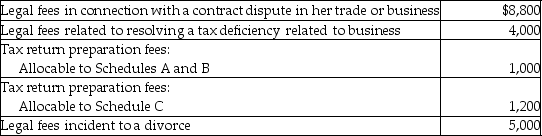

Leigh pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

A) $10,800

B) $14,000

C) $15,000

D) $20,000

Correct Answer:

Verified

Q21: Which of the following is not required

Q25: Laura,the controlling shareholder and an employee of

Q27: To be tax deductible,an expense must be

Q45: Charles is a single person,age 35,with no

Q53: Liz, who is single, lives in a

Q57: Various criteria will disqualify the deduction of

Q57: In 2014,Sean,who is single and age 44,received

Q58: Maria pays the following legal and accounting

Q72: On August 1 of the current year,Terry

Q87: The term "principal place of business" includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents