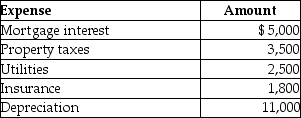

Mackensie owns a condominium in the Rocky Mountains. During the year, Mackensie uses the condo a total of 23 days. The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900. Mackensie incurs the following expenses in the condo:  Using the court's method of allocating expenses, the amount of depreciation that Mackensie may take with respect to the rental property will be

Using the court's method of allocating expenses, the amount of depreciation that Mackensie may take with respect to the rental property will be

A) $0.

B) $1,044.

C) $5,796.

D) $11,000

Correct Answer:

Verified

Q102: During the current year, Lucy, who has

Q105: Nikki is a single taxpayer who owns

Q106: During the current year, Paul, a single

Q109: Margaret, a single taxpayer, operates a small

Q111: Lindsey Forbes, a detective who is single,

Q126: Brent must substantiate his travel and entertainment

Q128: Vanessa owns a houseboat on Lake Las

Q401: List those criteria necessary for an expenditure

Q402: Ronna is a professional golfer. In order

Q411: Mickey has a rare blood type and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents