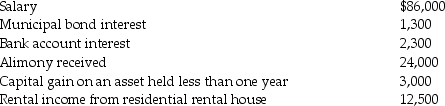

During the current year, Donna, a single taxpayer, reports the following items income of income and expenses:

Income:

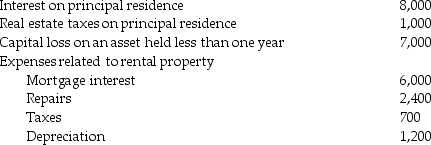

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income. (Show all calculations in good form.)

Compute Donna's taxable income. (Show all calculations in good form.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Desi Corporation incurs $5,000 in travel,market surveys,and

Q109: Margaret, a single taxpayer, operates a small

Q111: Lindsey Forbes, a detective who is single,

Q115: Abby owns a condominium in the Great

Q124: Gabby owns and operates a part-time art

Q126: Brent must substantiate his travel and entertainment

Q127: Lloyd purchased 100 shares of Gold Corporation

Q391: Discuss why the distinction between deductions for

Q402: Ronna is a professional golfer. In order

Q411: Mickey has a rare blood type and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents