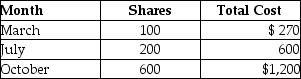

Edward purchased stock last year as follows:  In April of this year, Edward sells 80 shares for $250. Edward cannot specifically identify the stock sold. The basis for the 80 shares sold is

In April of this year, Edward sells 80 shares for $250. Edward cannot specifically identify the stock sold. The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Q3: Will exchanges a building with a basis

Q4: Richard exchanges a building with a basis

Q6: Jordan paid $30,000 for equipment two years

Q11: Antonio owns land held for investment with

Q12: Jack exchanged land with an adjusted basis

Q17: Which one of the following does not

Q37: Kathleen received land as a gift from

Q55: Dennis purchased a machine for use in

Q124: Because of the locked-in effect,high capital gains

Q134: If property received as a gift has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents