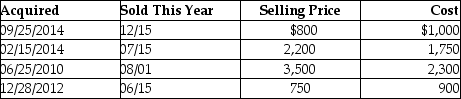

This year, Lauren sold several shares of stock held for investment. The following is a summary of her capital transactions for 2014:  What are the amounts of Lauren's capital gains (losses) for this year?

What are the amounts of Lauren's capital gains (losses) for this year?

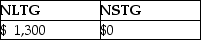

A)

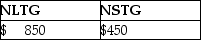

B)

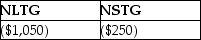

C)

D)

Correct Answer:

Verified

Q90: The taxable portion of a gain from

Q93: Darla sold an antique clock in 2014

Q95: Kendrick, who has a 35% marginal tax

Q99: Sari is single and has taxable income

Q100: To be considered a Section 1202 gain,the

Q101: On July 25,2013,Marilyn gives stock with a

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q105: Topaz Corporation had the following income and

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents