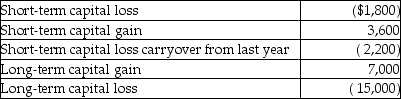

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

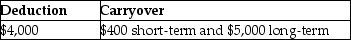

A)

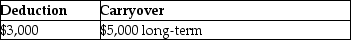

B)

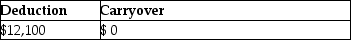

C)

D)

Correct Answer:

Verified

Q87: Renee is single and has taxable income

Q90: The taxable portion of a gain from

Q91: Coretta sold the following securities during 2014:

Q91: Andrea died with an unused capital loss

Q92: Joel has four transactions involving the sale

Q93: Gertie has a NSTCL of $9,000 and

Q93: Darla sold an antique clock in 2014

Q95: Kendrick, who has a 35% marginal tax

Q99: Sari is single and has taxable income

Q100: To be considered a Section 1202 gain,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents