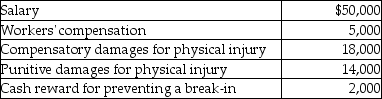

Joe Black, a police officer, was injured in the line of duty. He received the following during the current year:  What is the amount that is taxable?

What is the amount that is taxable?

A) $57,000

B) $66,000

C) $71,000

D) $84,000

Correct Answer:

Verified

Q61: Rick chose the following fringe benefits under

Q63: Fatima's employer funds child care for all

Q67: Healthwise Ambulance requires its employees to be

Q70: All of the following items are excluded

Q71: Carl filed his tax return, properly claiming

Q72: Chad and Jaqueline are married and have

Q73: Nelda suffered a serious stroke and was

Q74: Benefits covered by Section 132 which may

Q75: Miranda is not a key employee of

Q78: Which one of the following fringe benefits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents