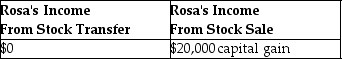

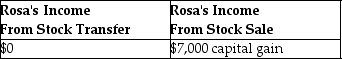

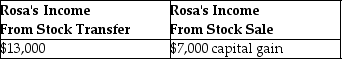

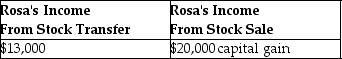

Under the terms of their divorce agreement executed in August of this year, Clint transferred Beta, Inc. stock to his former wife, Rosa, as a property settlement. At the time of the transfer, the stock had a basis to Clint of $55,000 and a fair market value of $68,000. Rosa subsequently sold the stock for $75,000. What is the tax consequence of first the stock transfer and then the stock sale to Rosa?

A)

B)

C)

D)

Correct Answer:

Verified

Q48: Chance Corporation began operating a new retail

Q81: Julia,age 57,purchases an annuity for $33,600.Julia will

Q84: Thomas and Sally were divorced last year.As

Q95: Lily had the following income and losses

Q102: As a result of a divorce,Michael pays

Q104: In addition to Social Security benefits of

Q109: On April 1,2014,Martha,age 67,begins receiving payments of

Q113: During 2013,Christiana's employer withheld $1,500 from her

Q129: Emma is the sole shareholder in Pacific

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents