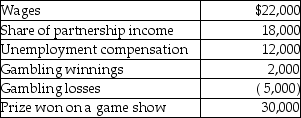

Lori had the following income and losses during the current year:  What is Lori's adjusted gross income (not taxable income) ?

What is Lori's adjusted gross income (not taxable income) ?

A) $72,000

B) $79,000

C) $82,000

D) $84,000

Correct Answer:

Verified

Q62: Edward,a single taxpayer,has AGI of $50,000 which

Q65: Which of the following bonds do not

Q77: Carla redeemed EE bonds which qualify for

Q79: Amy's employer provides her with several fringe

Q85: Eva and Lisa each retired this year

Q86: Bridget owns 200 shares of common stock

Q87: The requirements for a payment to be

Q88: As a result of a divorce,Matthew pays

Q91: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q120: The term "Social Security benefits" does not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents