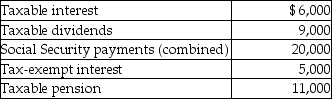

Mr. & Mrs. Bronson are both over 65 years of age and are filing a joint return. Their income this year consisted of the following:  They did not have any adjustments to income. What amount of Mr. & Mrs. Bronson's social security benefits is taxable this year?

They did not have any adjustments to income. What amount of Mr. & Mrs. Bronson's social security benefits is taxable this year?

A) $0

B) $4,500

C) $10,000

D) $20,000

Correct Answer:

Verified

Q48: Chance Corporation began operating a new retail

Q107: Homer Corporation's office building was destroyed by

Q109: On April 1,2014,Martha,age 67,begins receiving payments of

Q109: The Cable TV Company, an accrual basis

Q112: Leigh inherited $65,000 of City of New

Q113: During 2013,Christiana's employer withheld $1,500 from her

Q114: Marisa and Kurt divorced in 2012.Under the

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q129: Emma is the sole shareholder in Pacific

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents