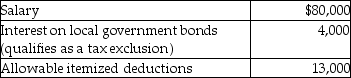

A single taxpayer provided the following information for 2014:  What is taxable income?

What is taxable income?

A) $57,050

B) $63,050

C) $63,000

D) $67,050

Correct Answer:

Verified

Q1: All of the following items are deductions

Q12: All of the following items are included

Q41: In 2014 Brett and Lashana (both 50

Q44: Anita,who is divorced,maintains a home in which

Q46: Deborah,who is single,is claimed as a dependent

Q49: Ben,age 67,and Karla,age 58,have two children who

Q51: Sarah,who is single,maintains a home in which

Q54: Which of the following is not considered

Q56: David's father is retired and receives $14,000

Q60: Lewis,who is single,is claimed as a dependent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents