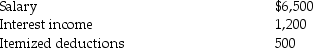

The following information for 2014 relates to Emma Grace, a single taxpayer, age 18:

a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Q83: In order to shift the taxation of

Q103: Shane and Alyssa (a married couple)have AGI

Q104: Hannah is single with no dependents and

Q106: Rena and Ronald,a married couple,each earn a

Q107: A taxpayer can receive innocent spouse relief

Q108: Form 4868,a six-month extension of time to

Q110: The following information is available for Bob

Q116: Lila and Ted are married and have

Q120: Adam attended college for much of 2014,during

Q127: Rob is a taxpayer in the top

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents