Sandy and Larry each have a 50% interest in SL Partnership. The partnership and the individuals file on a calendar year basis. In 2014, SL Partnership had a $30,000 ordinary loss. Sandy's adjusted basis in her partnership interest on January 1, 2014 was $12,000. In 2015, SL Partnership had ordinary income of $20,000. Assuming there were no other adjustments to Sandy's basis in the partnership, what amount of partnership income (loss) would Sandy show on her 2014 and 2015 individual income tax returns?

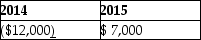

A)

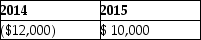

B)

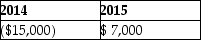

C)

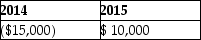

D)

Correct Answer:

Verified

Q41: Hal transferred land having a $160,000 FMV

Q41: Sari transferred an office building with a

Q63: All of the following are separately stated

Q67: All of the following statements are true

Q75: George transferred land having a $170,000 FMV

Q77: Thomas and Miles are equal partners in

Q81: Bryan Corporation, an S corporation since its

Q82: Atiqa receives a nonliquidating distribution of land

Q84: Stephanie owns a 25% interest in a

Q86: Which of the following statements regarding the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents