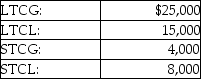

Summer Corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

A) $6,000 NSTCG included in gross income.

B) $6,000 NLTCG included in gross income.

C) $10,000 NLTCG is included in gross income and $4,000 NSTCL is carried over to the next year.

D) $10,000 NLTCG receives long-term capital gain treatment and $4,000 NSTCL included as ordinary loss.

Correct Answer:

Verified

Q8: All of the following are accurate statements

Q46: For this tax year, Madison Corporation had

Q50: With respect to charitable contributions by corporations,

Q52: June Corporation has the following income and

Q53: A corporation has the following capital gains

Q54: Musketeer Corporation has the following income and

Q55: Jenkins Corporation has the following income and

Q85: A corporation's E&P is equal to its

Q91: If a corporation has no E&P,a distribution

Q96: A corporation redeems 10 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents