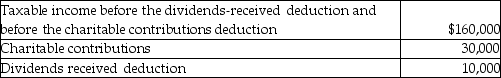

Corey Corporation reported the following results for the current year:  What is the amount of the charitable contribution carryover to next year?

What is the amount of the charitable contribution carryover to next year?

A) $0

B) $14,000

C) $16,000

D) $30,000

Correct Answer:

Verified

Q37: If a corporation's charitable contributions exceed the

Q42: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q50: For purposes of the accumulated earnings tax,reasonable

Q50: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q53: Charades Corporation is a publicly held company

Q64: When computing a corporation's alternative minimum taxable

Q65: Mason Corporation is a personal service corporation

Q70: Louisiana Land Corporation reported the following results

Q71: The corporate tax return has been prepared

Q72: A corporation has regular taxable income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents