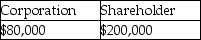

A corporation distributes land worth $200,000 to its sole shareholder. The corporation had purchased the land several years ago for $120,000. The corporation has over $1 million of E&P. How much income will the corporation and the shareholder recognize?

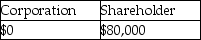

A)

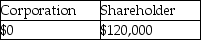

B)

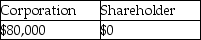

C)

D)

Correct Answer:

Verified

Q26: Dixie Corporation distributes $31,000 to its sole

Q70: Major Corporation's taxable income for the current

Q73: Individuals Julie and Brandon form JB Corporation.Julie

Q79: Individuals Opal and Ben form OB Corporation.Opal

Q82: A calendar-year corporation has a $75,000 current

Q88: A calendar-year corporation has a $15,000 current

Q92: Individuals Terry and Jim form TJ Corporation.Terry

Q93: Daniel transfers land with a $92,000 adjusted

Q101: Corkie Corporation distributes $80,000 cash along with

Q113: Ron transfers assets with a $100,000 FMV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents