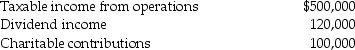

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Oak Corporation manufactures widgets in its factory

Q107: A corporation distributes land with a FMV

Q112: Ten years ago Finn Corporation formed a

Q113: Crowley Corporation has the following income during

Q114: Atomic Corporation is enjoying a very profitable

Q115: A corporation is owned 70% by Jones

Q116: Sycamore Corporation's financial statements show the following

Q117: When is the due date for the

Q120: A corporation is owned 70% by Jones

Q120: Topper Corporation makes a liquidating distribution of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents