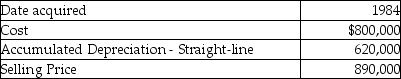

A corporation sold a warehouse during the current year. The straight-line depreciation method was used. Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Q2: Hilton,a single taxpayer in the 28% marginal

Q7: Jillian,whose tax rate is 39.6%,had the following

Q44: With respect to residential rental property

A)80% or

Q64: Eric purchased a building in 2003 that

Q71: Lucy, a noncorporate taxpayer, experienced the following

Q74: Octet Corporation placed a small storage building

Q84: Douglas bought office furniture two years and

Q91: Clarise bought a building three years ago

Q94: All of the following are considered related

Q108: Cobra Inc.sold stock for a $25,000 loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents