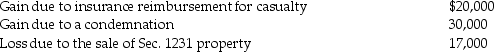

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.

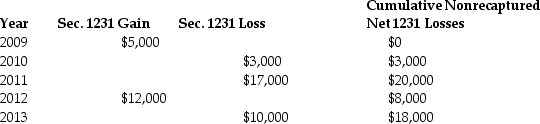

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Jesse installed solar panels in front of

Q83: On June 1,2011,Buffalo Corporation purchased and placed

Q84: WAM Corporation sold a warehouse during the

Q86: Connors Corporation sold a warehouse during the

Q89: Brian purchased some equipment in 2014 which

Q92: Pam owns a building used in her

Q96: Jed sells an office building during the

Q106: Pete sells equipment for $15,000 to Marcel,his

Q107: Jacqueline dies while owning a building with

Q1702: Sarah owned land with a FMV of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents