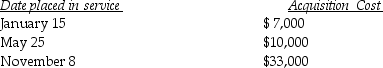

Greta, a calendar-year taxpayer, acquires 5-year tangible personal property in 2014 and places the property in service on the following schedule:

Greta elects to expense the maximum under Section 179, and selects the property placed into service on November 8. Her business 's taxable income before section 179 is $190,000. What is the total cost recovery deduction (depreciation and Sec. 179)for 2014?

Greta elects to expense the maximum under Section 179, and selects the property placed into service on November 8. Her business 's taxable income before section 179 is $190,000. What is the total cost recovery deduction (depreciation and Sec. 179)for 2014?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Costs that qualify as research and experimental

Q72: On January l Grace leases and places

Q74: On August 11,2014,Nancy acquired and placed into

Q76: Everest Corp. acquires a machine (seven-year property)on

Q80: On January 1, 2014, Charlie Corporation acquires

Q82: On June 30,2014,Temika purchased office furniture (7-year

Q88: In January of 2014,Brett purchased a Porsche

Q93: Bert,a self-employed attorney,is considering either purchasing or

Q2119: Why would a taxpayer elect to capitalize

Q2122: Discuss the options available regarding treatment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents