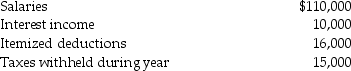

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Larry and Ally are married and file

Q78: During the current tax year,Charlie Corporation generated

Q84: Peyton has adjusted gross income of $20,000,000

Q87: Frederick failed to file his 2014 tax

Q94: Which is not a component of tax

Q95: Jeffery died in 2014 leaving a $16,000,000

Q96: Latashia reports $100,000 of gross income on

Q2194: A presidential candidate proposes replacing the income

Q2220: Doug and Frank form a partnership, D

Q2227: Explain how returns are selected for audit.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents