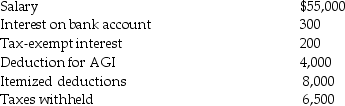

Chris, a single taxpayer, had the following income and deductions during 2014:

Calculate Chris's tax liability due or refund for 2014.

Calculate Chris's tax liability due or refund for 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Larry and Ally are married and file

Q73: Rocky and Charlie form RC Partnership as

Q76: Which of the following is not an

Q83: The term "tax law" includes

A)Internal Revenue Code.

B)Treasury

Q84: The Senate equivalent of the House Ways

Q86: Mia is self-employed as a consultant.During 2013,Mia

Q89: Leonard established a trust for the benefit

Q91: A tax bill introduced in the House

Q95: The IRS must pay interest on

A)all tax

Q95: Jeffery died in 2014 leaving a $16,000,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents