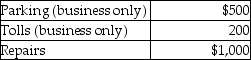

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

A) $11,200.

B) $12,200.

C) $11,950.

D) $13,200.

Correct Answer:

Verified

Q15: A three- day investment conference is held

Q21: Rajiv, a self-employed consultant, drove his auto

Q21: All of the following are allowed a

Q21: Taxpayers may use the standard mileage rate

Q27: Chuck, who is self- employed, is scheduled

Q29: Richard traveled from New Orleans to New

Q31: Norman traveled to San Francisco for four

Q33: Commuting to and from a job location

Q33: Ron is a university professor who accepts

Q40: David acquired an automobile for $30,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents