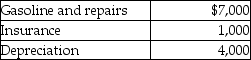

Rajiv, a self-employed consultant, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

A) $8,325

B) $9,000

C) $6,325

D) $7,000

Correct Answer:

Verified

Q3: Travel expenses for a taxpayer's spouse are

Q5: In determining whether travel expenses are deductible,a

Q6: Allison,who is single,incurred $4,000 for unreimbursed employee

Q7: If an individual is not "away from

Q19: Jason,who lives in New Jersey,owns several apartment

Q26: Brittany, who is an employee, drove her

Q31: Norman traveled to San Francisco for four

Q33: Ron is a university professor who accepts

Q33: Commuting to and from a job location

Q40: David acquired an automobile for $30,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents