Martin Corporation granted a nonqualified stock option to employee Caroline on January 1, 2012. The option price was $150, and the FMV of the Martin stock was also $150 on the grant date. The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1, 2015 when the stock's FMV was $250. If Caroline sells the stock on September 5, 2016 for $300 per share, she must recognize

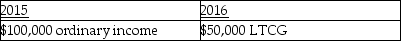

A)

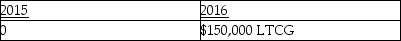

B)

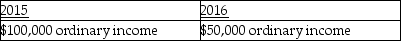

C)

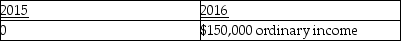

D)

Correct Answer:

Verified

Q64: Tobey receives 1,000 shares of YouDog! stock

Q71: All of the following characteristics are true

Q77: In a contributory defined contribution pension plan,all

Q79: Sam retired last year and will receive

Q80: All taxpayers are allowed to contribute funds

Q85: A partnership plans to set up a

Q108: Characteristics of profit-sharing plans include all of

Q113: Tessa is a self-employed CPA whose 2015

Q116: Martin Corporation granted an incentive stock option

Q118: The maximum tax deductible contribution to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents