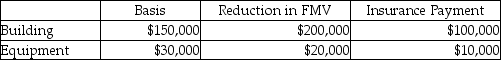

Lena owns a restaurant which was damaged by a tornado. The following assets were partially destroyed:  Lena has AGI of $50,000. What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000. What is the amount of Lena's deductible casualty loss?

A) $54,900

B) $60,000

C) $70,000

D) $180,000

Correct Answer:

Verified

Q54: A taxpayer may deduct a loss resulting

Q61: Which of the following is most likely

Q70: In the case of casualty losses of

Q70: When business property involved in a casualty

Q71: If a taxpayer suffers a loss attributable

Q73: A theft loss is deducted in the

Q73: In the current year, Marcus reports the

Q76: Aretha has AGI of less than $100,000

Q90: Wesley completely demolished his personal automobile in

Q199: What is required for an individual to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents