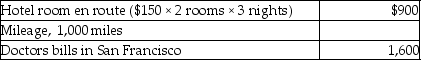

In 2015 Sela traveled from her home in Flagstaff to San Francisco to seek medical care. Because she was unable to travel alone, her mother accompanied her. Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

A) $1,600.

B) $2,130.

C) $2,500.

D) $2,730.

Correct Answer:

Verified

Q4: Due to stress on the job,taxpayer Charlie

Q5: Expenditures for a weight reduction program are

Q6: For individuals,all deductible expenses must be classified

Q6: If the principal reason for a taxpayer's

Q7: If a prepayment is a requirement for

Q12: Medical expenses are deductible as a from

Q17: In order for a taxpayer to deduct

Q17: The definition of medical care includes preventative

Q18: If a medical expense reimbursement is received

Q20: Expenditures incurred in removing structural barriers in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents