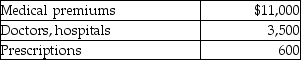

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000. He is single and age 58. Caleb also receives a reimbursement for medical expenses of $1,000. Caleb's deductible medical expenses that will be added to the other itemized deduction will be

A) $10,350.

B) $9,100.

C) $14,100.

D) $15,100.

Correct Answer:

Verified

Q8: A medical expense is generally deductible only

Q12: All of the following are deductible as

Q22: Mr. and Mrs. Gere, who are filing

Q23: Alan, who is a security officer, is

Q30: Linda had a swimming pool constructed at

Q31: The following taxes are deductible as itemized

Q39: Foreign real property taxes and foreign income

Q266: Explain under what circumstances meals and lodging

Q270: Discuss the timing of the allowable medical

Q276: Patrick and Belinda have a twelve- year-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents