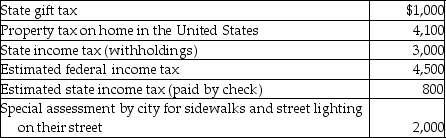

During the year Jason and Kristi, cash basis taxpayers, paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

A) $7,900

B) $8,900

C) $10,900

D) $15,400

Correct Answer:

Verified

Q36: Doug pays a county personal property tax

Q41: Finance charges on personal credit cards are

Q41: A taxpayer is allowed to deduct interest

Q42: Taxpayers may not deduct interest expense on

Q44: Taxpayers may elect to include net capital

Q45: Investment interest expense which is disallowed because

Q48: In general,the deductibility of interest depends on

Q53: Interest expense incurred in the taxpayer's trade

Q55: Investment interest includes interest expense incurred to

Q284: Discuss what circumstances must be met for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents