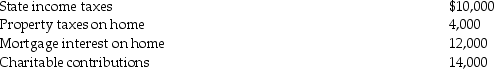

Tasneem, a single taxpayer has paid the following amounts in 2015:  Tasneem's AGI is $360,250. What is her net itemized deduction allowed?

Tasneem's AGI is $360,250. What is her net itemized deduction allowed?

A) $40,000

B) $38,490

C) $36,940

D) None of the above.

Correct Answer:

Verified

Q97: All casualty loss deductions,regardless of the type

Q107: Legal fees for drafting a will are

Q113: During 2015 Richard and Denisa, who are

Q116: Patrick's records for the current year contain

Q120: Daniel had adjusted gross income of $60,000,

Q347: Jorge contributes $35,000 to his church and

Q352: What is the treatment of charitable contributions

Q357: Explain how tax planning may allow a

Q359: Explain what types of tax planning are

Q363: Jill is considering making a donation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents