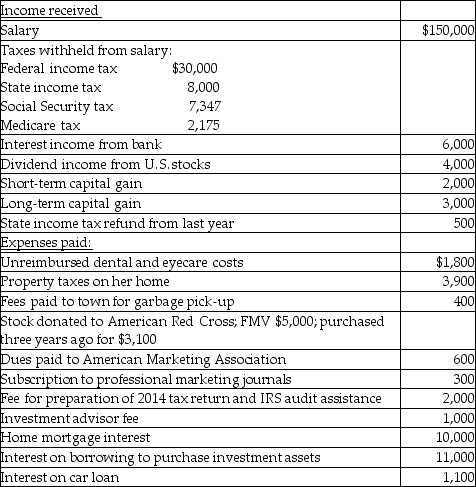

Hope is a marketing manager at a local company. Information about her 2015 income and expenses is as follows:  Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Correct Answer:

Verified

Q102: What is the result if a taxpayer

Q103: A taxpayer can deduct a reasonable amount

Q104: Christa has made a $25,000 pledge to

Q109: Grace has AGI of $60,000 in 2014

Q109: Wang, a licensed architect employed by Skye

Q115: Ivan's AGI is about $50,000 this year,and

Q349: May an individual deduct a charitable contribution

Q357: Explain how tax planning may allow a

Q359: Explain what types of tax planning are

Q363: Jill is considering making a donation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents