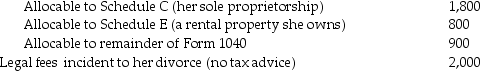

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency  Tax return preparation fees:

Tax return preparation fees:  What amount is deductible for AGI?

What amount is deductible for AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Fees paid to prepare a taxpayer's Schedule

Q23: Mark and his brother,Rick,each own farms.Rick is

Q25: Laura,the controlling shareholder and an employee of

Q26: An expense is considered necessary if it

Q27: To be tax deductible,an expense must be

Q39: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q40: Various criteria will disqualify the deduction of

Q391: Discuss why the distinction between deductions for

Q401: List those criteria necessary for an expenditure

Q405: Ben is a well- known professional football

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents