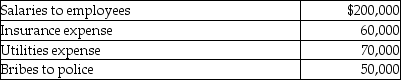

Troy incurs the following expenses in his business, an illegal gambling establishment:  His deductible expenses are

His deductible expenses are

A) $0.

B) $200,000.

C) $330,000.

D) $380,000.

Correct Answer:

Verified

Q27: Interest expense on debt incurred to purchase

Q40: Kickbacks and bribes paid to federal officials

Q42: At the election of the taxpayer,a current

Q51: Pat,an insurance executive,contributed $1,000,000 to the reelection

Q53: Jimmy owns a trucking business. During the

Q53: Which of the following factors is important

Q57: Emeril borrows $340,000 to finance taxable and

Q58: During the current year,Ivan begins construction of

Q402: Ronna is a professional golfer. In order

Q411: Mickey has a rare blood type and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents